Calculating return on investment over multiple years

That means the timing of the cash flows can impact the profitability of an investment but this wont always be indicated by the IRR. Recall the two IRR examples discussed above.

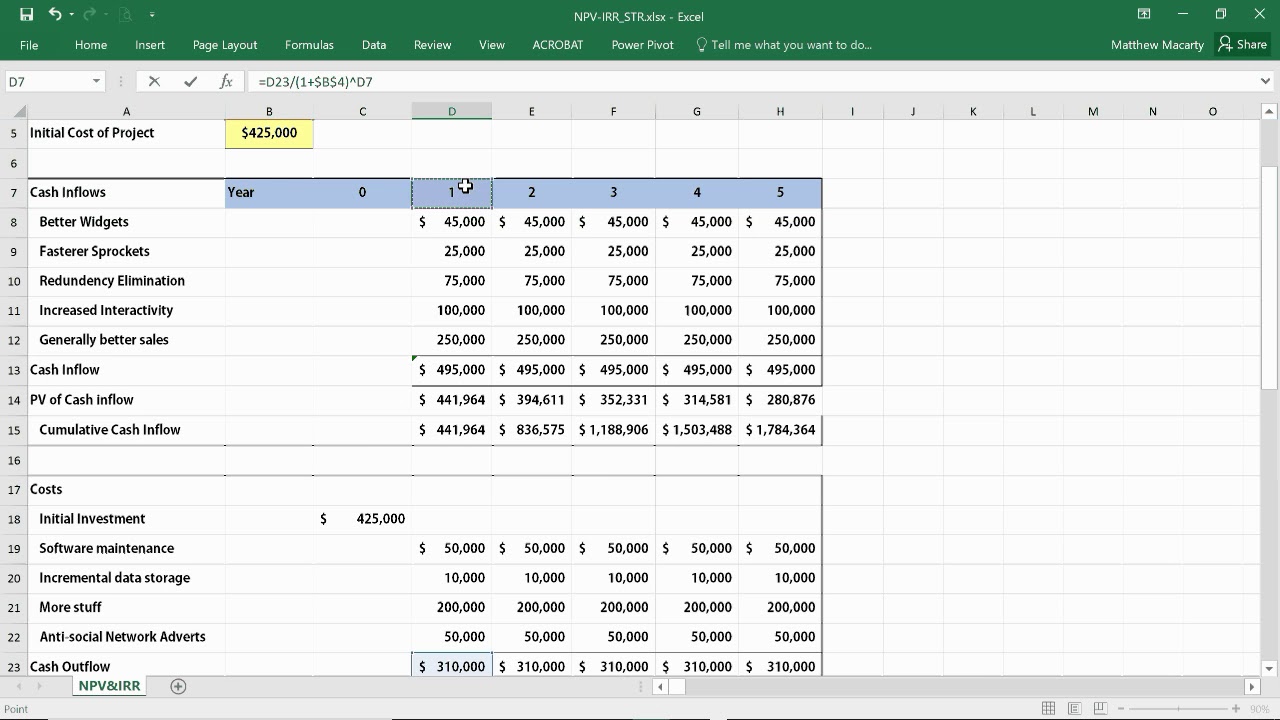

How To Calculate Npv Irr Roi In Excel Net Present Value Internal Rate Of Return Youtube

Cash Flow -Income Starting Amount PV 20000 Periodic Investment Amount Unknown Number of cash flows 288 24 years monthly ROR -68 average over 5 years Goal.

. It includes the value of all cash flows regardless of duration and is an. 113780 85335 28445 savings per year. We must then divide that amount by the cash outflow in Year 0.

In the case of investment 2 with an investment of 1000 in. You may need to claim a deduction for certain rental property expenses over a number of years such as borrowing decline in value and capital works. In order to calculate the multiple-on-money MoM well calculate the sum of all the positive cash inflows from each holding period.

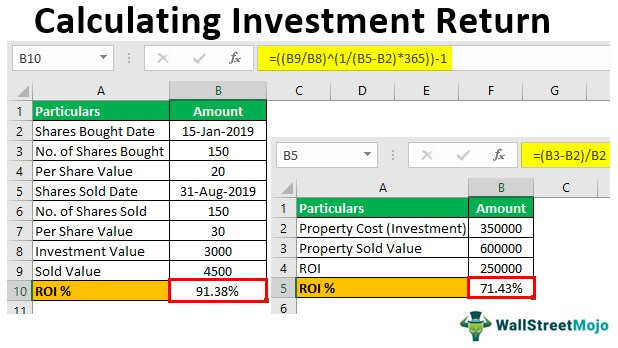

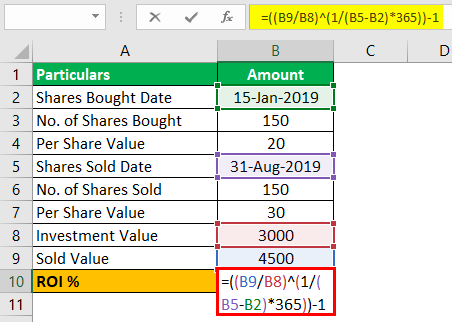

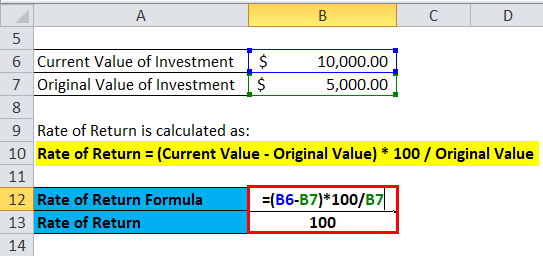

Formulas for Calculating Return on Investment with Excel. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. The formula for calculating cash on cash return is as follows.

1 Projections of the Financial Statements 2 Calculating the Free Cash Flow to Firms 3 Calculating the Discount Rate 4 Calculating the Terminal Value Calculating The Terminal Value The terminal value formula helps in estimating the value of a business beyond the explicit forecast period. To find the number of years for the second part of the calculation use the following formula. Internal rate of return IRR is a method of calculating an investments rate of returnThe term internal refers to the fact that the calculation excludes external factors such as the risk-free rate inflation the cost of capital or financial risk.

For instance assuming a Year 5 exit the exit proceeds of 210 million are divided by -85 million to get an MoM of 25x. You may also consider calculating the ROI. More Net Present Value NPV.

The final cost reduction example is slightly more complex. Even taking this worst-case scenario into account you still break even about halfway through the life of your 25-year panel warranty and stand to make a reasonable return on your investment. The Short Term Loan Shops rental property calculator can determine the cash on cash return and the cap rate for a potential investment property.

I am trying to establish what amount I could draw out as a pension income each month to sustain the investment for 24 years if the following notional figures are entered. Cash On Cash Return Annual Cash Flow Initial Cash Outlay x 100. The formula is easier to follow and comparisons can be made across investments years and even investors.

A rate of return is the gain or loss of an investment over a specified period of time expressed as a percentage of the investments cost. There are certain shortcomings in regards to tax benefits and return on investment ROI. The internal rate of return for an investment only measures the return each period on the unrecovered investment balance which can vary over time.

An accredited investor is someone with a net worth of at least 1 million excluding the value of their primary residence OR income of at least 200000 each year for the last two years or 300000 combined income if married. How long would it take to pay off the same 69kW system. Assuming that quality has slipped a bit since the company increased its output to 528 units per year they are now considering an improvement project to reduce returned products by 25 percent.

The project value is now. This means that in the case of investment 1 with an investment of 2000 in 2013 the investment will yield an annual return of 48. This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year.

The payback period balloons to 1345 years if you hire a contractor for installation. 1 Number of years 1. The method may be applied either ex-post or ex-anteApplied ex-ante the IRR is an estimate of a future annual rate of return.

What It Means and Steps. In many cases the seller will only provide a short list of operating expenses and earnings like utilities and gross annual income for you to look over before you decide to make a deal. Your income from the letting of property to a tenant or multiple tenants will not typically amount to the carrying on of a business as such activities are generally considered a form of.

In finance return is a profit on an investment.

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Roi Definition Equation How To Calculate It

Calculating Investment Return In Excel Step By Step Examples

Calculating Return On Investment Roi In Excel

Calculating Return On Investment Roi In Excel

Roi Calculator Formula The Online Advertising Guide Ad Calculators

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Rate Of Return Formula Calculator Excel Template

Return On Investment Roi Definition Equation How To Calculate It

Rate Of Return Formula Calculator Excel Template

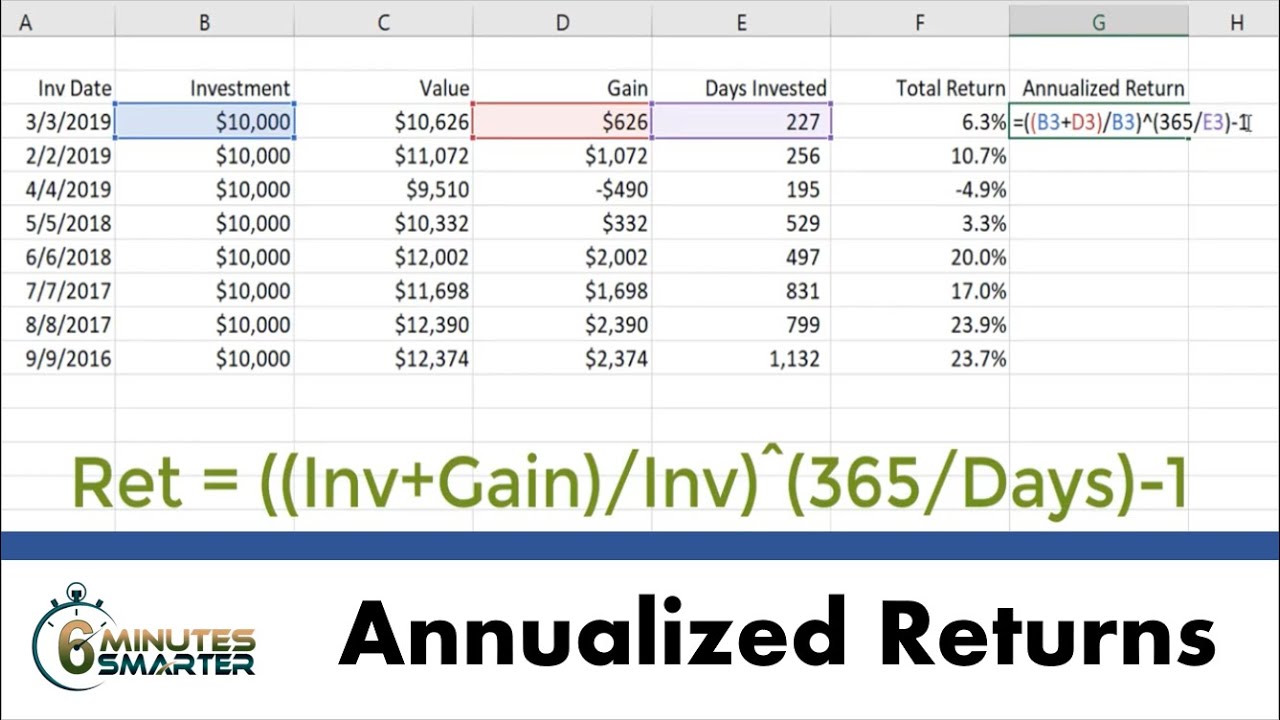

Calculate Annualized Returns For Investments In Excel Youtube

How Do You Use The Roi Formula On Excel Monday Com Blog

How Do You Use The Roi Formula On Excel Monday Com Blog

Return On Investment Roi Formula And Calculator

Calculating Return On Investment Roi In Excel

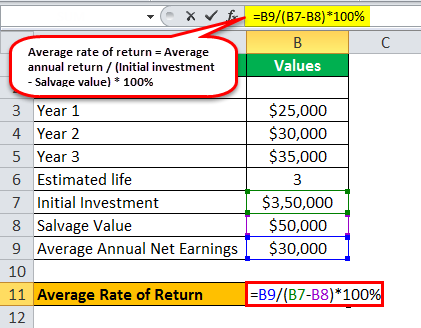

Average Rate Of Return Definition Formula How To Calculate

Internal Rate Of Return Irr Formula And Calculator